Environmental, Social & Governance

Venn is committed to delivering investment performance to its clients in a responsible manner, by considering the environmental, social and governance impacts of our investment decisions

Sustainability

Venn, as part of the ESR Group, takes an active approach towards sustainability and aims to create real value not only for our investors, but also for the users and communities of the assets we invest in.

“We believe that a sustainability led mindset is essential to delivering long term success. This mindset has directed our assessment and management of the ESG aspects of our business and provides a positive ethical impact on our own corporate performance and our investments, whilst also benefitting both the environment, local communities and the wider society.”

Gary McKenzie-Smith, Managing Partner

Our commitment towards sustainability is based on a foundation of robust ESG principles across the following two dimensions of behaviour:

- Our firm and our people;

- Our investments – strategies, investment selection and monitoring.

Environmental

- Minimising the impact of Venn’s operations and continually improving its environmental performance, including a commitment to be carbon neutral

- Compliant-ready across all relevant legislation, regulations and appropriate codes of practice

- Transparency: Venn will foster environmental awareness and understanding in our business and our stakeholders through regular engagement and reporting

- Extensive due diligence, where relevant/appropriate, to assess the environmental implications of an investment

Social

- Employee training promoting the awareness and understanding of ESG and D&I issues within the business

- Ensuring employee well-being across physical and mental health

- Job Opportunities: Venn is committed to being an equal opportunities employer and backs this up by aiming to identify candidates from a range of backgrounds in its recruitment process

- 1-1-1 Model: 1% of each of Venn’s profits and people’s time are given to support community causes, together with a commitment by the firm to be carbon neutral

- Evaluation of the social benefit and community enhancement of an investment or strategy

Governance

- Top down board level responsibility for ESG issues

- Stringent governance: Venn actively operates a code of ethics and policies for each of anti-money laundering, conflicts of interest, disciplinary and grievance, monitoring, inducements, gifts and anti-bribery, market conduct, personal account dealing and data security

- Transparency: We maintain a transparent management structure with robust internal procedures and controls

- Corporate behaviour: Venn insists on the highest levels of personal and professional integrity, professionalism, and honesty from its staff

- Due diligence to assess strength of stakeholders’ corporate governance

We firmly believe that ESG issues will increasingly influence the direction of our business plans, policies and decisions, as well as our engagement with various stakeholders. As part of the wider ARA Group, we benefit from the Group’s already extensive sustainability and ESG initiatives.

A copy of the firm’s ESG policy is available upon request, or alternatively view our ESG Report 2021.

Investment Approach

Our ESG framework is designed around a set of principles that apply across all aspects of the firm’s business, and is tailored to reflect the fact we operate in the private credit sector.

We are committed to delivering investment performance to our clients in a responsible manner and consider ESG factors to be of at least equal importance to other financial metrics when considering investments. The firm’s ESG policy outlines our approach to the investment process including the evaluation of investment strategies, pre-investment considerations and post-investment monitoring.

A comprehensive assessment of ESG factors is therefore an inherent part of our risk management framework and is embedded within the firm’s decision-making and due diligence processes. In addition, and consistent with their individual investment strategies, each underlying business unit has its own methods for incorporating ESG factors into the investment decision-making and monitoring processes.

When considering a potential investment:

| We use environmental criteria to assess how it will affect the natural environment, comply with relevant laws and regulations, and assist with the transition to a low carbon economy. |

| Applying a social set of standards, we evaluate the borrower’s approach to health & safety, labour standards and working conditions as well as the relationships it has with its stakeholders and the surrounding community. |

| We endeavour to understand the issues of sustainable investment addressed by our investors, and encourage all stakeholders to adhere to the highest level of corporate conduct and governance. |

More information on the firm’s investment approach can be found in our ESG policy, a copy of which is available upon request, and within our ESG Report for 2021.

1-1-1 Commitment

As part of our ESG policy, we have adopted the 1-1-1 model, which means that 1% of each of our profits and people’s time are given to support community causes, together with a commitment by the firm to be carbon neutral.

Pledge 1% of Time

At least 1% of our people’s time should be spent on community or charitable causes, some examples of which are shown below.

Pledge 1% of Profit

In addition to time spent on charitable endeavours, Venn contributes 1% of its profits to charitable donations.

100% Carbon Neutral

The firm is committed to being carbon neutral by seeking to both reduce and then offset its carbon emissions.

We were recently involved in the following community projects:

On 6 April 2023, 8 employees volunteered at City Harvest, a charity that collects surplus food from all segments of the food industry and then redistributes it to those that need it the most. Employees spend a busy day sorting through food donations and making deliveries.

We recently provided support to Freedom School, Moniya, in Nigeria, donating and arranging the transportation of a range of much needed I.T. and computer equipment. This project was completed alongside Power House Community Networks, a UK registered charity that sponsors social action via community outreach events.

In October, Vicky To successfully completed the London Parks Half-Marathon, raising much needed funds in support of Smart Works. This amazing charity sources workwear for women from disadvantaged backgrounds in order that they can attend job interviews whilst also providing interview training and support.

On 14 June 2022, 11 August 2022 and 23 February 2023, a team of enthusiastic employees gave their time to assist Coram with the clean-up of their Creative Therapies Pears Pavilion play-area and surrounding gardens, at the site’s headquarters at Brunswick Square. The work involved introducing lots of topsoil and bark chippings together with weeding and raking as well as general garden maintenance.

On 24 May 2022, seven members of the team tied up their running laces and took part in the LandAid 10k Run in Regent’s Park, raising over £2,900 for young people experiencing homelessness. All monies raised for this event will be put towards creating bed spaces for some of the most vulnerable people in our society.

On 12 and 13 May, Venn took part in the second ARA Chiltern Classic. ARA and friends cycled some 150kms of inclines and escarpments around the Chilterns Massif to raise over £15,000. These much-needed funds were donated to two extremely worthy causes: Coram and the DEC Ukraine Humanitarian Appeal.

On 8 March 2023, female employees at Venn and ARA Europe met for an informal breakfast to acknowledge and celebrate International Women’s Day. This was a great opportunity for the women from both offices to get together to show their support for this important initiative and strike the pose for #EmbraceEquity. In addition, in recognition of the importance of supporting women in the workplace, and as part of its ESG initiative, Venn and ARA Europe organised a second-hand clothes drive, with all items being donated to Smart Works, a charity that seeks to assist disadvantaged women return to the workplace. Team members from Venn also participated in a sponsored bike ride, cycling over 600 miles and raising much-needed funds for Smart Works.

On 24 November 2021, in conjunction with Thames 21, employees participated in a Vegetation Management Project alongside the River Brent in Perivale Park. This was a physically demanding activity that involved ‘scrub bashing’, cutting back small trees, nettles and other plants in order to create a small path running alongside the river. Opening up areas along the river’s bank encourages river vegetation, thereby improving the local ecosystem and benefitting wildlife whilst also providing greater access to the area for the local community to enjoy.

On 15 July 2021, we teamed up with Thames 21 to participate in a Thames River Charity Clean-up. 22 team members worked with grit and determination to pick up over two large containers full of rubbish, including hundreds of wet wipes, plastic items, clothing, shoes and other debris. Thames 21 mobilises thousands of volunteers every year to clean and green the capital’s 400-mile network of waterway, which provides a huge benefit to local communities, wildlife and the environment. We were delighted to play our part in helping the environment.

March 2021 saw employees participate in the Race the Thames challenge, a week-long virtual race in which the team worked together to row, run, walk and/or cycle the distance from the source of the Thames to its estuary (343km). A collective distance of 1290km was covered over 166 hours, and over £4500 was raised and shared between the London Youth Rowing and Thames 21 charities.

In December 2020, employees spent the day volunteering with Thames 21, assisting with a project to regenerate the former Royal hunting ground of Enfield Chase by planting new trees along the Salmon’s Brook. Restoring the area’s tree cover reduces the flood risk for local homes and businesses whilst also benefitting the local wildlife. The teams competitive spirit kicked in with over 500 trees being planted throughout the day.

We participated in a scheme to donate old computers and hardware which were recently redistributed to schools in Nigeria. Not only we did donate several items of equipment, we also contributed to the shipping costs.

In 2019 our employees spent two days clearing rubbish on the beaches of Bournemouth. This not only served the community but was a great bonding exercise for the team.

In October 2019 employees raised over £6,500 in an Apprentice-style challenge to raise funds for Indigo Volunteers, a charity that recruits volunteers and connects them with humanitarian projects across the globe.

Other volunteering projects supported by our employees as part of the firm’s 1% time commitment include:

- Signing up with Inspiring the Future, a charity which seeks to inspire young people by connecting volunteers with state schools and colleges to talk about their careers

- Serving food at the Southwark Day Centre for Asylum Seekers

- Assisting Sheen Mount Primary School with the school’s Safeguarding and Pupil Premium Grant Scheme for underprivileged kids

- Making Christmas box donations through the Young Lives Foundation and Operation Christmas Child

- Assisting with a conservation project in Leckhampton Hill

- Participating in the Marie Curie Virtual Brain Game Quiz, which raised over £400,000 to support Marie Curie nurses.

Over the years, we have supported the charities highlighted below. In 2023, we became a member of The Academy of Real Assets which connects schools and students to some of the UK’s leading real estate and real assets firms through events and work experience opportunities, with the aim of increasing socioeconomic diversity in the industry:

Our commitment to be Carbon Neutral

Venn recognises the importance of protecting the environment and seeks to minimise the impact of its operations and continually improve its own environmental performance. We are committed to both reducing and offsetting the firm’s carbon footprint. Over the last few years, we have calculated our corporate-level emissions, which we have offset by purchasing carbon credits to support various conservation projects both in the UK and overseas.

As well as offsetting our own carbon emissions, we actively encourage, and arrange for, our employees to volunteer with community projects that are beneficial to the environment; recent examples of which include a tree planting project at Enfield Chase, a conservation project in Leckhampton Hill and a beach clean-up in Bournemouth.

Responsibility

Venn has established a dedicated ESG committee with responsibility for overseeing and setting the firm’s ESG strategy, which is then approved by the board. The committee meets on a monthly basis and is comprised of management representatives across Venn’s key business units and functions.

ESG issues are a standing item for the agenda of the board. The firm’s current ESG policy was approved by the board in February 2021. A copy of this policy is available upon request, by emailing moc.srentrap-nnevnull@ofni.

ESG within the ESR Group

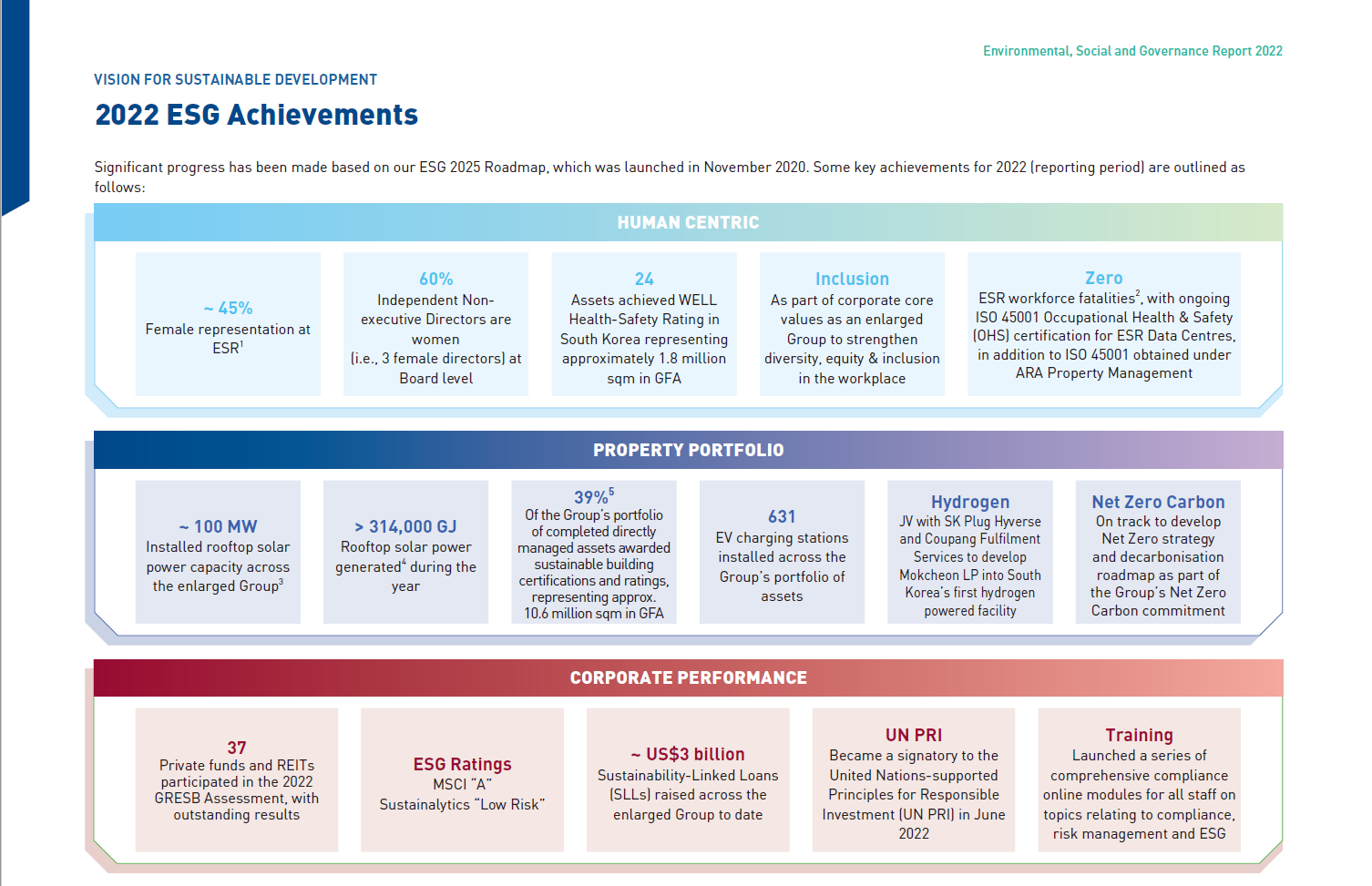

Since January 2021, Venn and the ARA Group have been part of the ESR Group, APAC’s largest real asset manager powered by the New Economy and the third largest listed real estate investment manager globally.

Sustainability sits at the heart of ESR’s business practices as they seek to integrate ESG factors into every aspect of their business operations. ESR recently achieved outstanding results in the 2022 Global Real Estate Sustainability Benchmark (GRESB) Assessment, in recognition of its exemplary ESG performance. ESR is also a signatory to the UN PRI.

For further information, please see the ESG 2030 Roadmap and the ESR 2022 Sustainability Report. Additional information is also available on ESR’s website.

ESR Highlights

ESR Accolades